- Turnover in the first half of the year grew by 19% compared to the same period of the previous year, reaching €205.8 million, despite a less favorable exchange rate and a highly pressured pricing environment.

- As the semester progressed, successive tariff measures implemented by the U.S. administration, including a 50% import duty on steel and aluminum since early June, caused a halt in purchasing and investment decisions by distributors and operators.

- The total impact of tariffs on the Group’s EBITDA in the first six months of the year is estimated at approximately €15 million.

- In this complex context, EBITDA posted a negative result of €0.7 million in the first half of the year.

- Under these circumstances, Tubos Reunidos is boosting commercial activity in complementary markets to mitigate the impact of tariffs on U.S. sales, while also implementing cost-containment policies and operational measures to improve production efficiency.

- The company will apply a Temporary Redundancy Scheme (ERTE) at the Amurrio plant from September 1, 2025, to February 28, 2026.

Amurrio, July 24, 2025. Tubos Reunidos Group today published its results for the first half of fiscal year 2025, reflecting the impact of international trade restrictions and tariff policies in a market filled with uncertainty and stalled international demand due to an unstable and changing regulatory environment. This is undoubtedly one of those downturn phases typical of a cyclical industry such as seamless tubes.

The growth in the order book in the last months of 2024 allowed the company to boost its turnover in the first half of the year to €205.8 million, 19% higher than in the same period of the previous year, despite a less favorable exchange rate and a high-pressure pricing environment. However, as the semester progressed, the tariff policies adopted by the U.S. administration, including import tariffs on steel and aluminum, which have stood at 50% since early June have led to a halt in purchasing and investment decisions by distributors and operators. As a result, the order book volume has decreased by 26% compared to its value at the end of 2024. This uncertainty has also affected the dollar exchange rate, which has suffered a sharp depreciation against the euro, negatively impacting the margin of some orders in the backlog and damaging the competitive position of European companies.

In the first half of 2025, the Group recorded a negative operating result of €10.8 million and a consolidated net loss attributable to the parent company of €28.4 million. EBITDA stood at negative €0.7 million (compared to positive €5.3 million in the same period of the previous year). The total effect of tariffs on the Group’s EBITDA in the first six months of the year is estimated at around €15 million, stemming from the costs incurred by the tariffs, customer cancellations, and the drop in orders.

To address the current uncertainty, the Group has adopted several measures, including boosting commercial activity in complementary markets to mitigate the impact of tariffs on U.S. sales, cost-containment policies, and operational measures to improve production efficiency. Additionally, during the first half of 2025, a Temporary Redundancy Scheme (ERTE) for production-related reasons was implemented at the TRPT plant in Iruña de Oca, with a maximum incidence rate of 50%.

Financial situation

The Group continues to prioritize optimizing its cash position. In April 2025, it agreed with financial institutions to modify the maturity schedule of the syndicated loan, bond B, and the FASEE loan (SEPI). Thus, the principal payments scheduled for 2025, corresponding to the early repayment using the funds from the sale of the Sestao steel mill and the regular amortization for the fiscal year, amounting to €15.2 million and €12 million, respectively — have been deferred to 2026 and 2027. However, early repayment may still be made before those dates if surplus cash is recovered. This measure aims to provide the company with sufficient liquidity to face the previously described market challenges and uncertainties.

A strong focus on working capital management enabled the Group to generate an operating cash flow of €4.8 million in the first half. Investment payments totaled €4.8 million. Financial payments corresponded to interest on the various financing instruments, including a €1.3 million payment to FASEE for the 2024 profit-sharing interest, accrued due to the positive pre-tax result of the previous year. Additionally, the downward trend in eurozone interest rates is helping reduce expenses on variable-rate loans (debt A and FASEE) and working capital financing instruments.

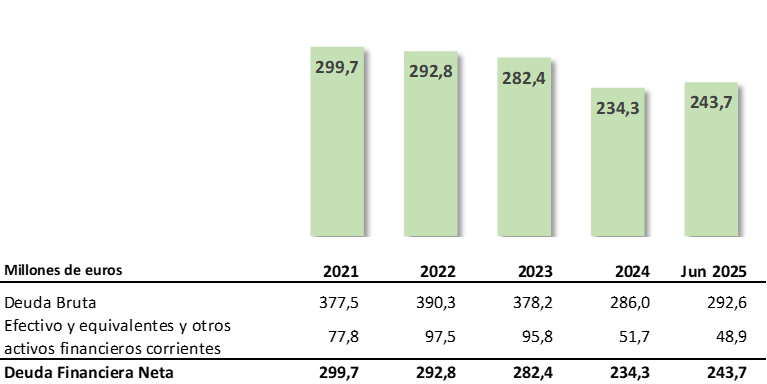

Net debt stood at €243.7 million at the end of the semester, up from €234.3 million as of 12/31/24, with the following evolution:

Outlook

The Group faces a second half marked by uncertainty stemming from the tariff situation and the evolution of the conflicts in Ukraine and the Middle East. It also remains attentive to the outcome of ongoing negotiations between the U.S. government and the European Union — extended until August 1 — which could result in an agreement to reduce the impact of U.S. tariffs on steel and aluminum and establish a stable market framework. Such an agreement would enable medium-term planning and encourage affected companies to make purchasing and investment decisions.

Tubos Reunidos is actively adapting to this uncertain reality. It is strengthening its access to customers and projects in alternative markets showing positive prospects, such as Canada, India, and Saudi Arabia, and has reinforced its commercial presence in Europe by opening a German office at the beginning of 2025. Likewise, the Group has prioritized cost and investment control to protect its cash position and be prepared for a potential and expected demand recovery.